RAISING THE FLOOR: Quarter Million in Earned Trader Funding

How I Passed $150K in ADD’L Trading Funding in 3 Days -100% with 0 Losses

In April, after about a month and a half I passed my first $100K Prop Trading Funding challenge.

Here’s my fancy certificate:

Once you pass the challenge you earn a Funded Account with $100K in buying power.

Here were the objectives/rules to pass:

$6,000 Profit Target

$2,000 Daily Loss Limit

$3,000 Max Loss Limit

Best day can’t be more than 50%

It was a great challenge that provided a lot of insights and data for me to analyze and use to take next steps.

So, most prop firms allow you to copy trade to several accounts.

And with a winning strategy, it can be a great way to amplify/multiply your wins across several accounts.

It’s also great way to spread your risks amongst several accounts, allowing you the opportunity, with the proper risk/account management, to “trade another day” …

Let me explain.

In the $100K account you can trade a maximum of 10 Contracts.

Some traders will max out the number of contracts they trade and blow up their accounts, as they hit their max loss limit quicker than if they had traded smaller.

That said, if you wanted to trade 10 Contracts you can spread that out amongst 5 accounts and only risk 2 contracts per account.

Same risk, but it’s spread across several accounts.

“Live to trade another day!”

Now, keep in mind, no matter what, you can multiply your losses and your gains quickly, so risk/account management is the most important thing to remember.

So, after analyzing some data and running some backtests on the strategies I was implementing when I passed my $100K challenge, I knew I could do better and pass some challenges more efficiently and quickly.

The best way to do this was to “RAISE THE FLOOR”

What is this “Raise the Floor” thing?

Okay, so, I’m a member of TGA [The Guardian Academy] and one of the foundational concepts I love is: Raising the Floor.

As Nic Peterson so eloquently shared …

“The fastest way to compound success is not higher highs, but higher lows.

Raise the floor.”

[You can read more about Raising the Floor by clicking → here]

So, for the next set of challenges I did something that most traders have a terrible time doing.

NOT trading.

When I was looking over the data I noticed that the risk/reward on certain trades wasn’t worth taking those specific trades. So … I just didn’t take them.

And if it meant not trading for the entire session, I didn’t take a trade.

Yeah, I know. “NUTS RIGHT!”

That said, the first 3 days of the challenge, I was a legit … spectator, not a speculator.

But it ultimately saved me from having to dig out of losses and I was able to keep all the gains.

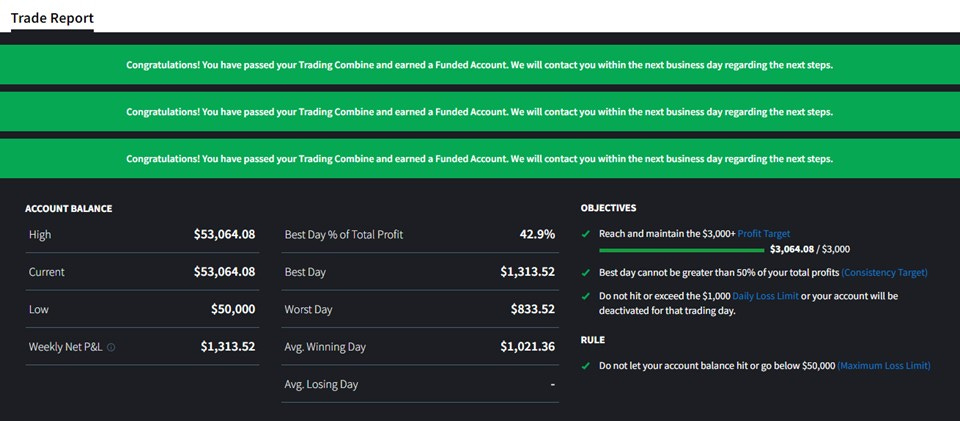

So after 3 days, 100% and 0 losses, I was able to hit the profit goal and pass the $150K in additional earned funding, bringing my total of passed funded challenges to a Quarter Million.

Addition by subtraction!

Here were the objectives/rules for $50K Account:

$3,000 Profit Target

$1,000 Daily Loss Limit

$2,000 Max Loss Limit

Best day can’t be more than 50%

My goal is to have 5 Funded Accounts total and copy trade across all accounts.

I may dedicate the next challenge strictly to our Digital Gold friend and only trade Bitcoin Futures [the Micros people, let’s not get crazy].

The challenges have been great, but now the real tests of showing restraint and discipline need to be conquered and mastered.

“Making it” and “keeping it” are two very different things, not just in trading but life in general.

I’m getting the “making it” thing down.

But the “keeping it” thing is and always will be the psychological aspect that me, we, us, as humans, need to work on the most.

What gets us there, ain’t gonna keep us there!

Once I get my 5 Accounts passed and rolling, the intention is to lock myself out of, at the least, 3 accounts … once I hit my “Days Pay”.

This will help me to build the discipline of not over trading and securing the “bag” … [profits].

[Quick shoutout to TopstepX for the “Lock Out” feature … great platform, check out.]

Raising the floor, and showing restraint, collapsed a shit ton of time in this last round of challenges.

To repeat that process will not be easy and is absolutely not typical.

But the bar has been set.

Next challenge will be a nail biter. LOL.

I will share my progress as I go.

Bitcoin Futures is a whole other beast.

I’ve traded BTC before and the volatility can be ratchet! [Keep me in your thoughts!]

Will share the cool dashboards and indicator updates next post.

Likely to give free access to the main dashboard [free for now] coming here soon … this is a snapshot of the latest version.

[And yes … you can set the tickers to any 5 tickers you want, that are available on TradingView.]

Shout out to everyone that’s made it this far!

Make sure to subscribe if you haven’t already.

Also, make sure to share this with your favorite traders and/or aspiring traders.

FOMC is tomorrow … so be safe out there.

Happy Trading!

- V

Principles in action. Fantastic. Congrats.

Love this TGA principled approach to trading.

Great to see you putting it to work and winning Vivica!!!

👏🏾

Bien hecho 🥳